- Roll flows have kicked off in most European bond futures.

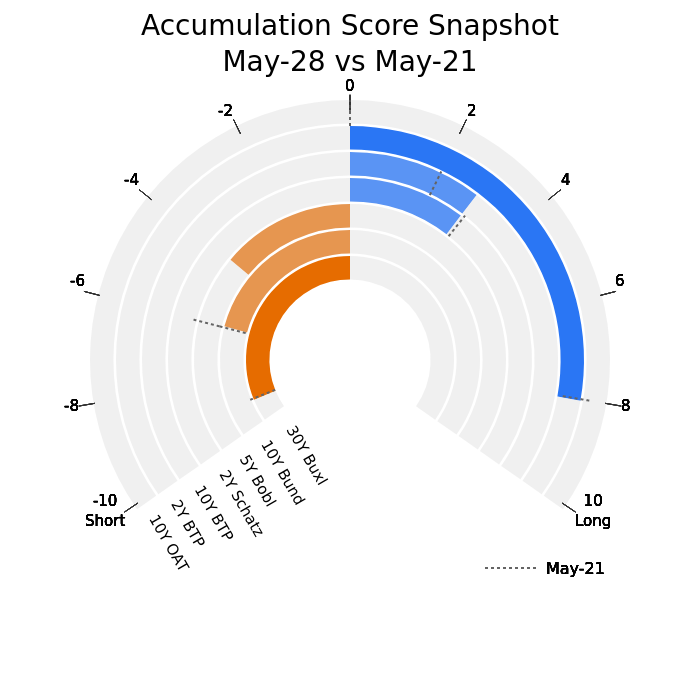

- The BUXL and BUND enters the roll phase with a short bias, more pronounced at the longer end.

- We identify the key levels and clusters where the largest outstanding positions are concentrated.

Roll activity has commenced across the European bond futures complex, and positioning shows a clear skew to the short side in the German longer-dated contracts.

Among the most significant moves, BUXL futures have reached concentrated short positioning levels. Our model flagged a -10 Concentrated Short signal last Friday, triggering a sharp 300-tick bounce. Despite the rebound, short positions remain dominant, with the Accumulation Score still at -8

The BUND shows a similarly bearish bias, albeit less extreme, with a -7 score. In contrast, the 10Y BTP and 10Y OAT futures are trading closer to neutral positioning levels.

At the short end of the curve, the SCHATZ has moderated from a previously crowded long (which coincided with the local top at 107.50 on April 7) and now reflects a more neutral score of +3. Meanwhile, the 2Y BTP is holding a long bias with an Accumulation Score of +8.

As we head into the roll, we provide a breakdown of where positioning is most concentrated in BUXL, BUND, BOBL, SCHATZ, BTPS and OAT futures, with key levels identified for each..

Currently, BUXL is trading just below the largest cluster of outstanding short positions, located in the 121.15–121.35 range (see chart below). These levels will be critical as roll activity intensifies.

Positioning Analysis by Instrument

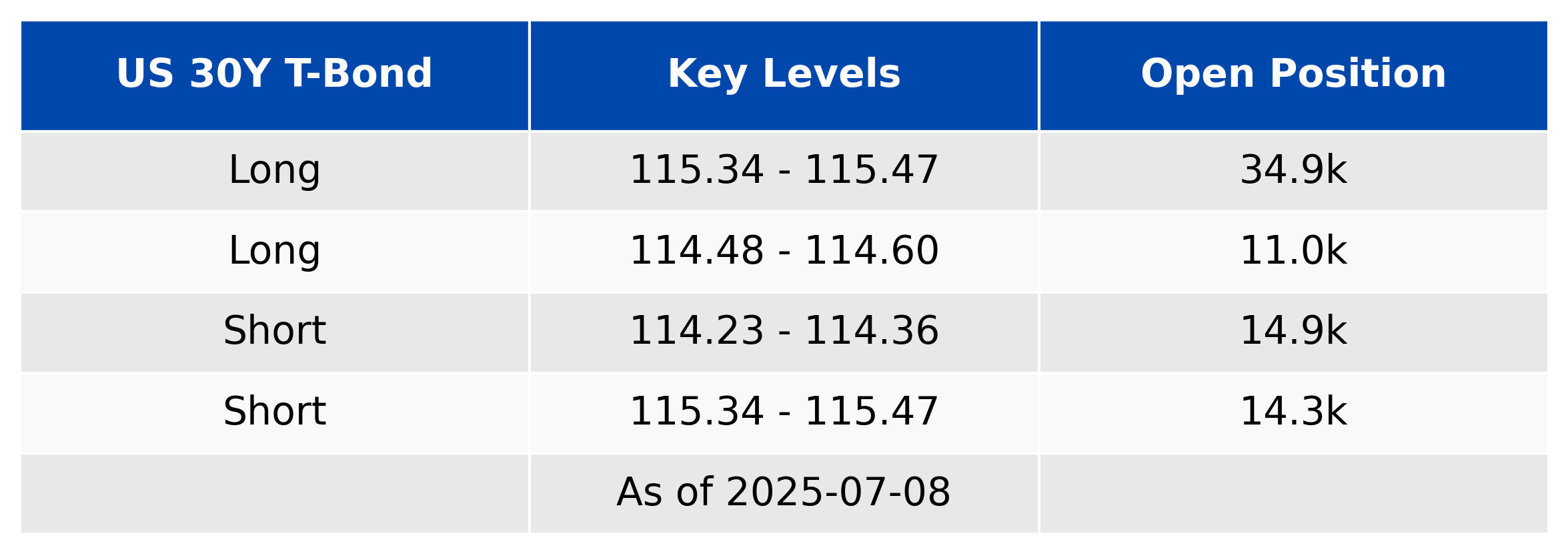

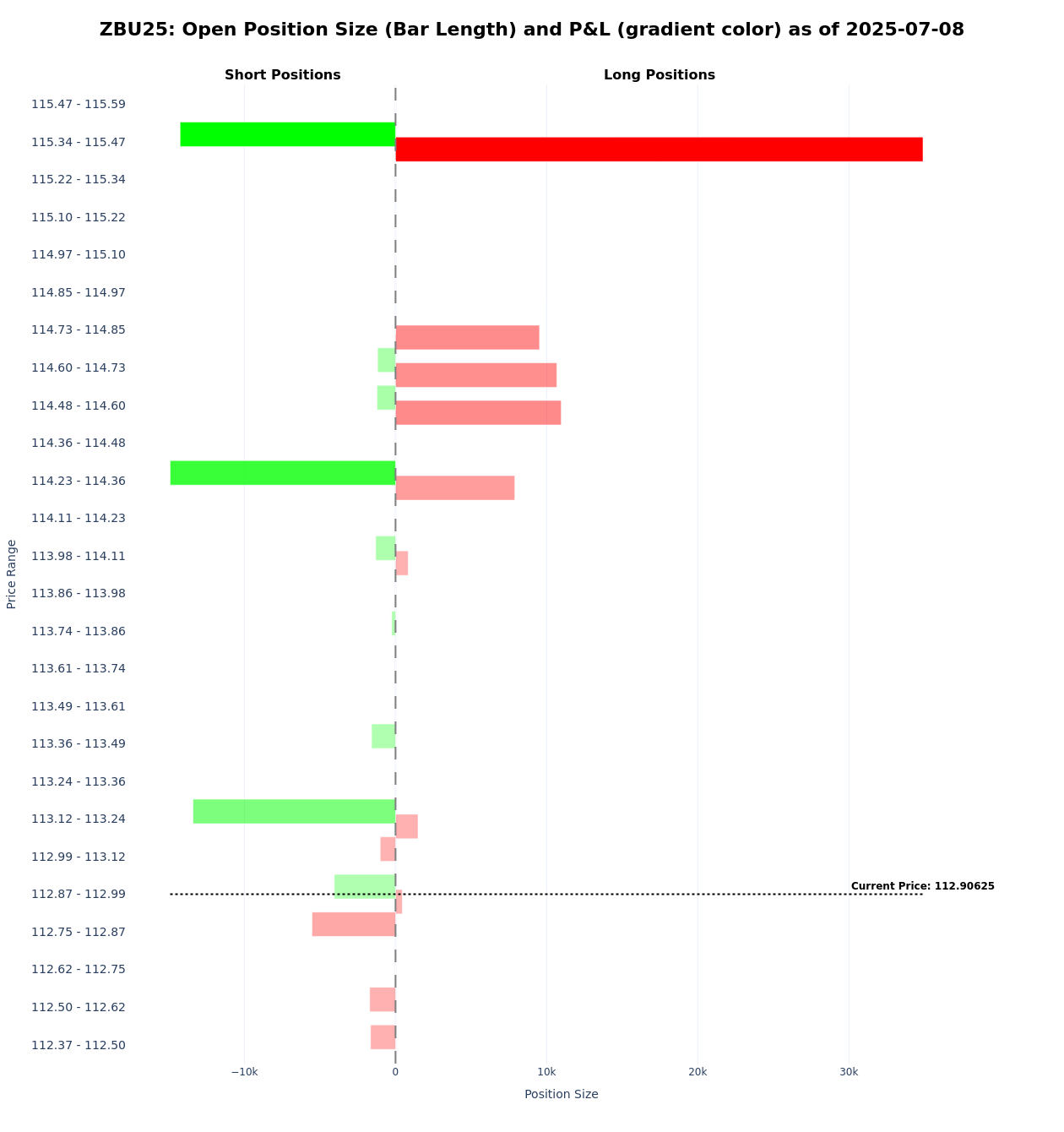

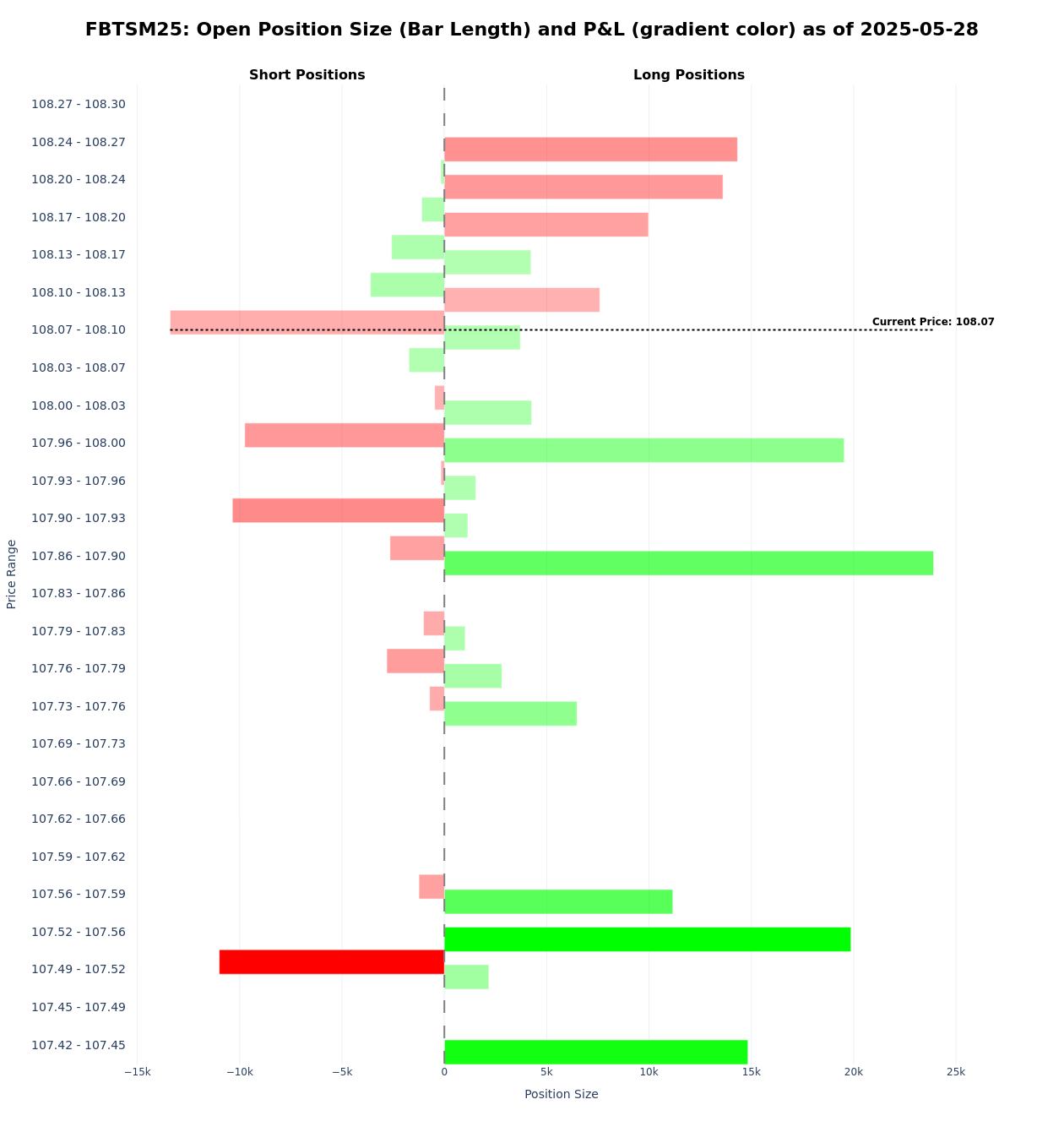

US 30Y T-Bond

Top Open Positions by Price Level

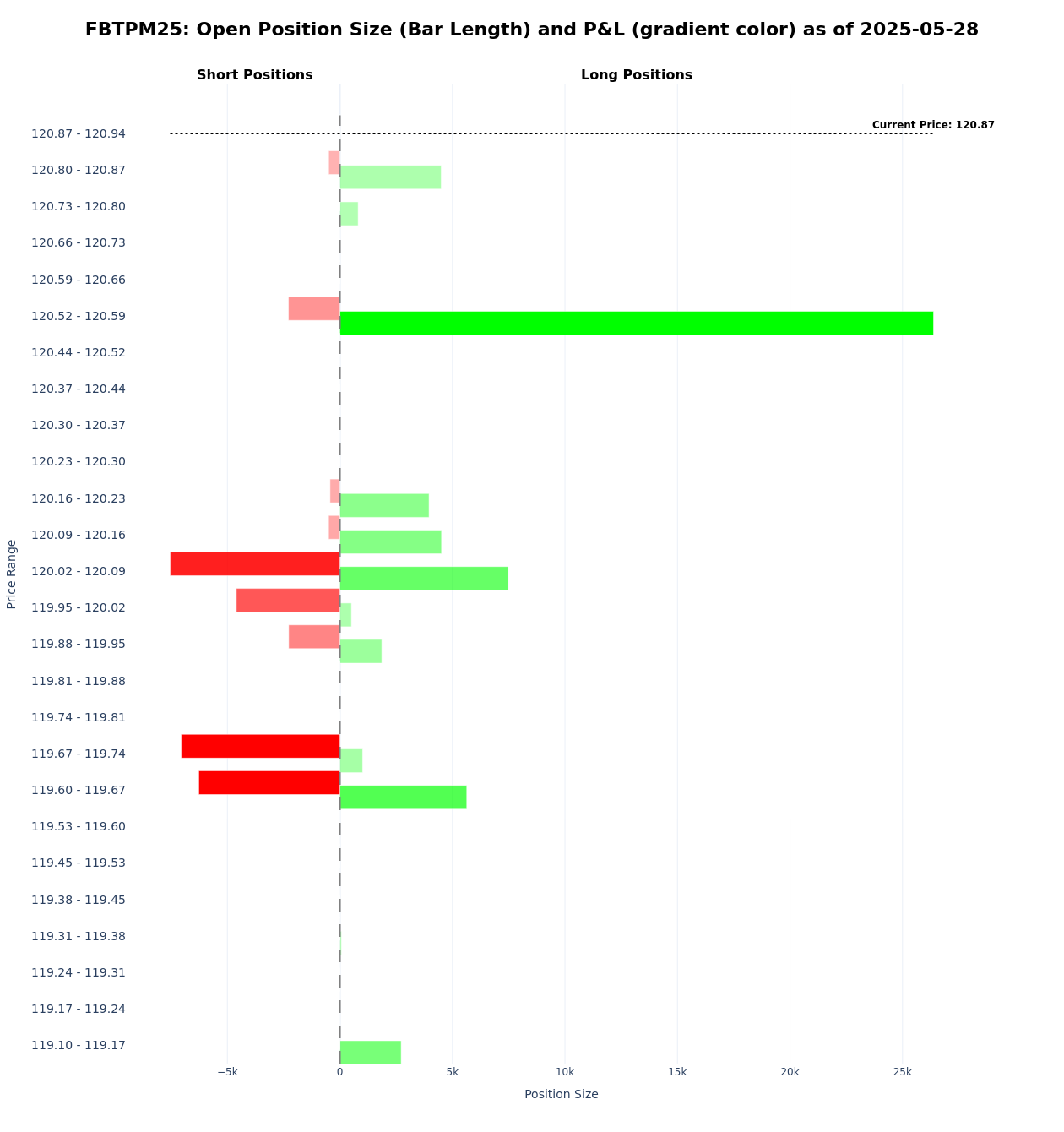

BUND

Like the longer end, BUNDs have seen short momentum ease, but positioning remains skewed short with a -7 score.

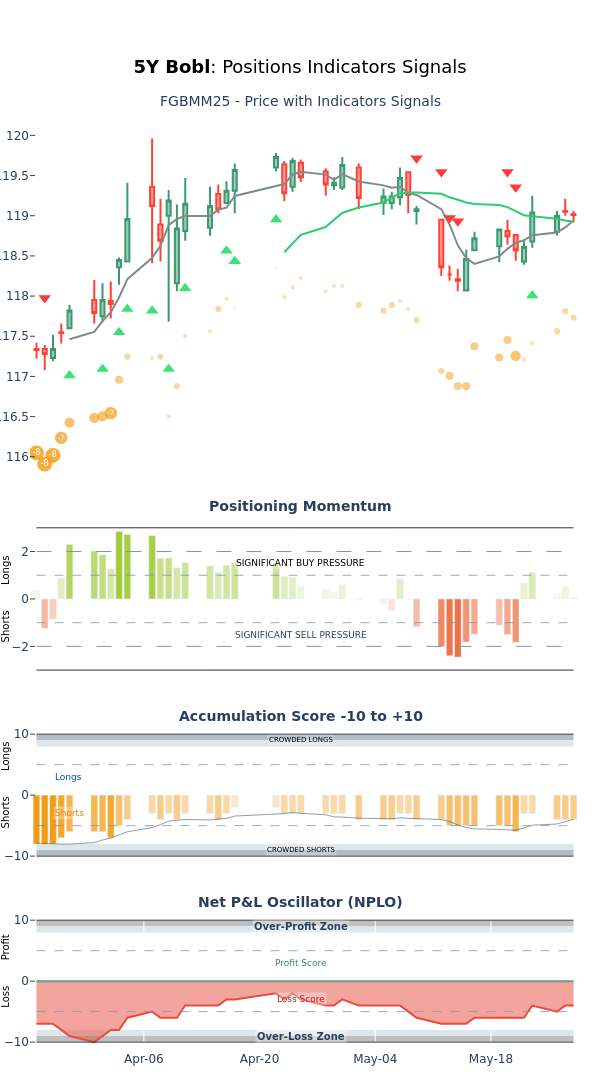

BOBL

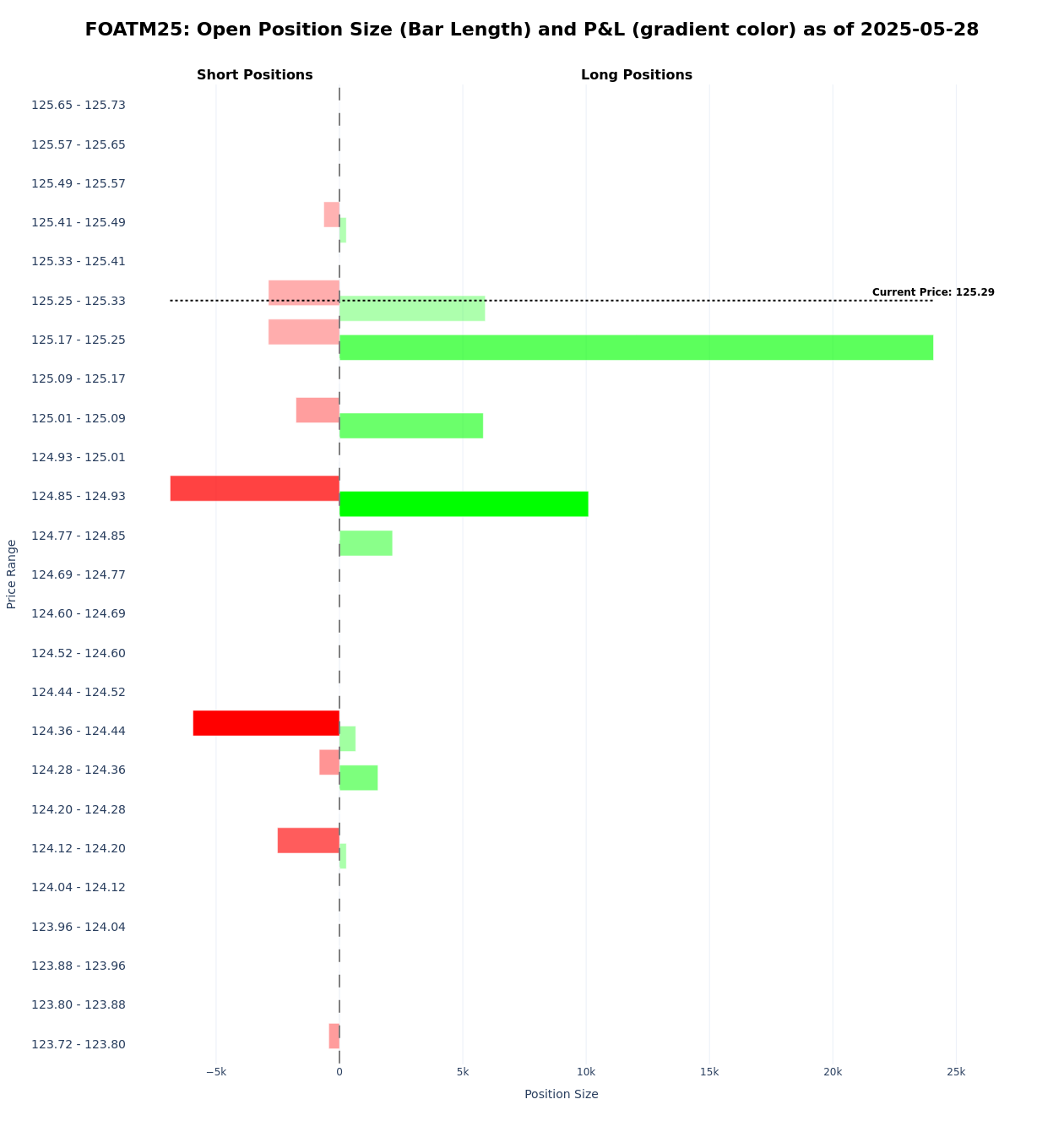

BOBL positioning is more balanced, hovering near neutral levels, with a more modest short bias reflected in a -4 Accumulation Score.

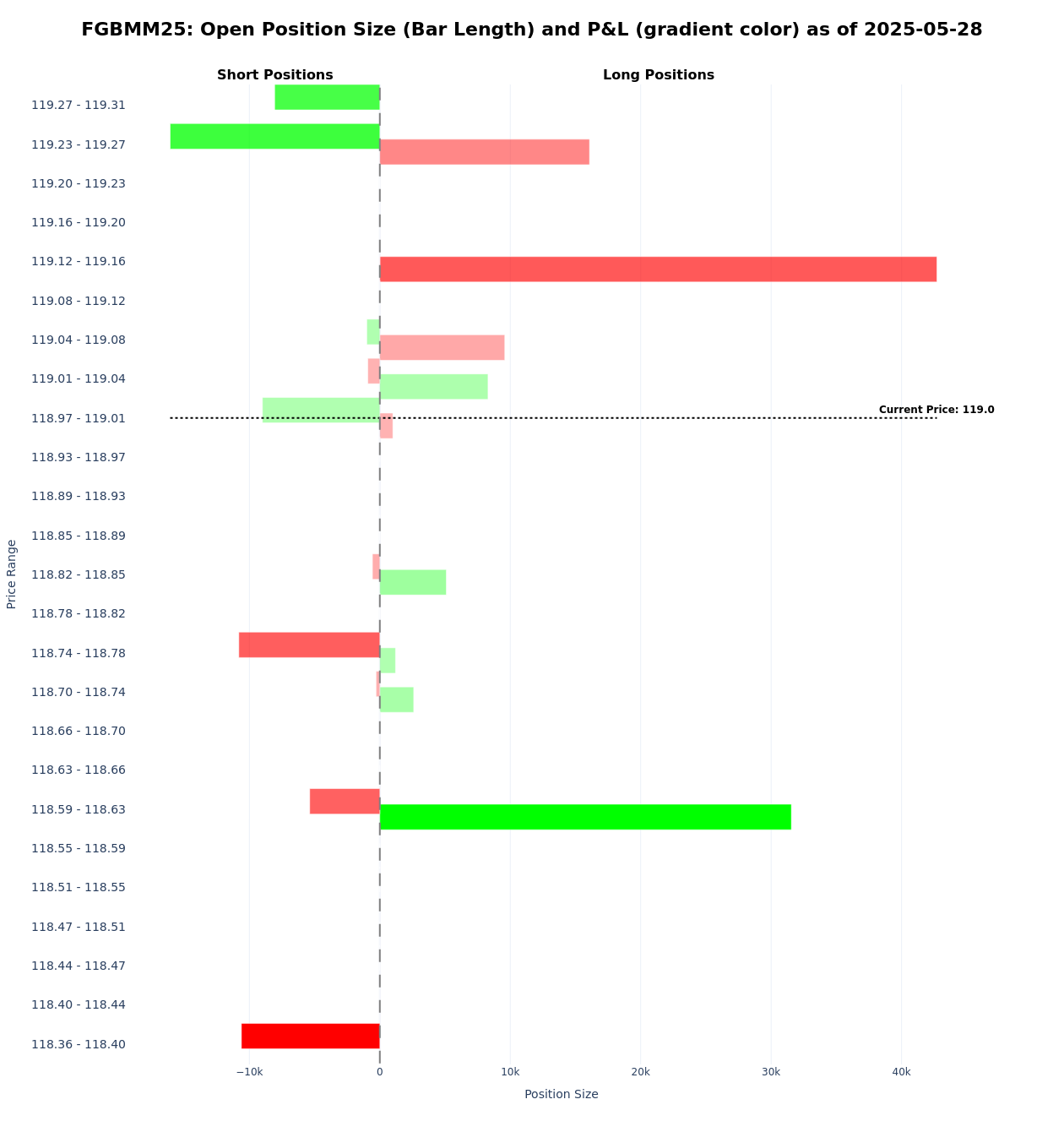

SCHATZ

At the short end, the April rally was supported by strong long positioning momentum (see green triangles in the chart), peaking as the Accumulation Score reached a +10, indicating a crowded long. As we enter the roll phase, the SCHATZ now holds a neutral positioning score.

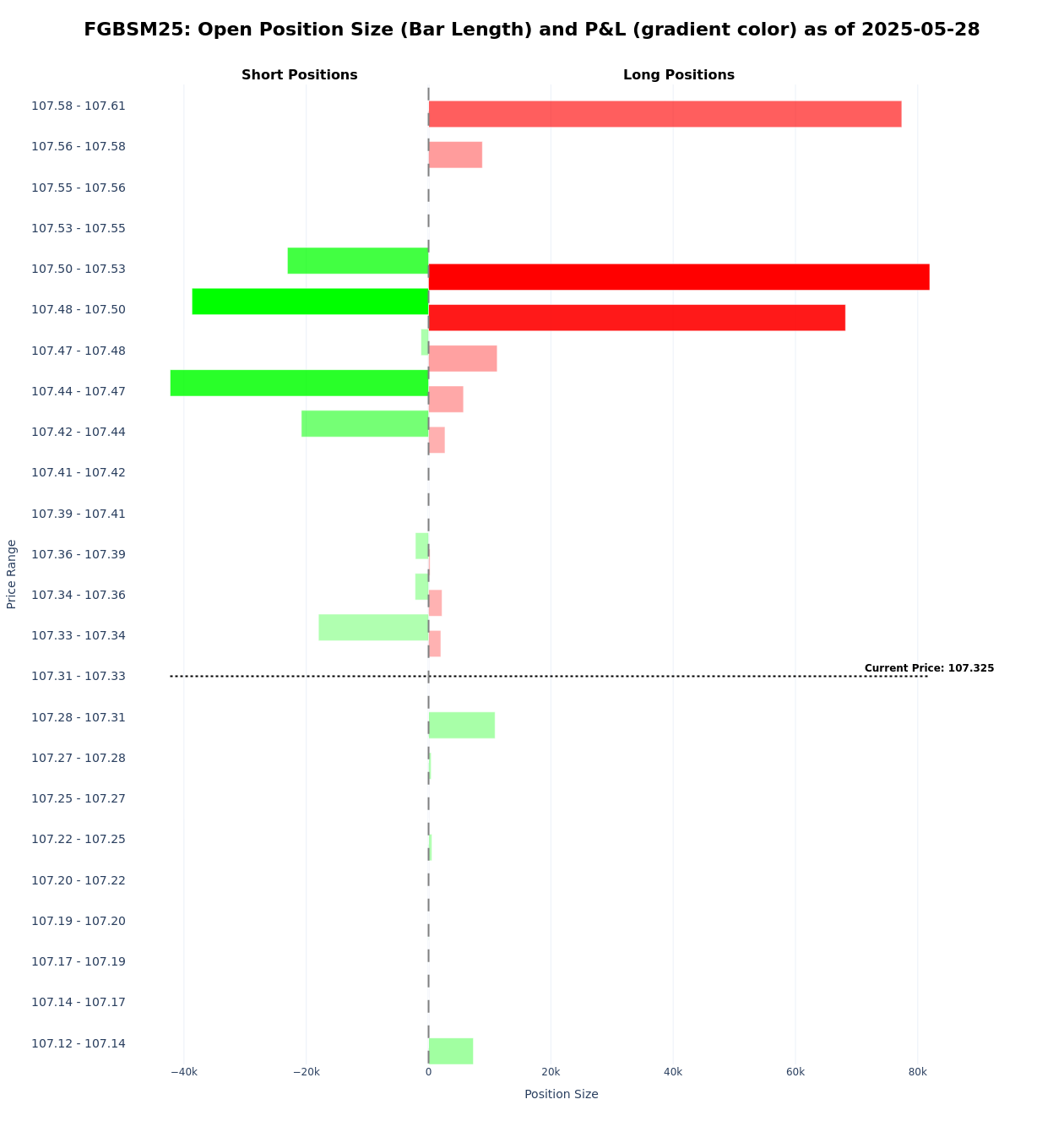

10Y BTP

The short positioning seen in the German long end was far less pronounced in the 10Y BTP, which saw its long bias moderate, from a peak of +5 to a more neutral +3, as we enter the roll phase.

2Y BTP

The 2Y BTP June contract has experienced a sustained build-up in long positions, supported by strong long positioning momentum (see green triangles in the chart). The long bias has eased slightly, with the Accumulation Score dipping from +10 to +8.

10Y OAT

The 10Y OAT currently shows a much more neutral positioning profile.