FUTURES POSITIONING

Systematic Monitoring of Long and Short Market Positions, Positioning Momentum and Imbalances

Introduction to the Model

The Futures Positioning Model offers a comprehensive and systematic analysis of market positions, providing traders and portfolio managers with invaluable insights into the behavior of futures market participants. This cutting-edge model estimates the current positioning of long and short trades while building a detailed historical profile of positions for any futures instrument.

Core Features

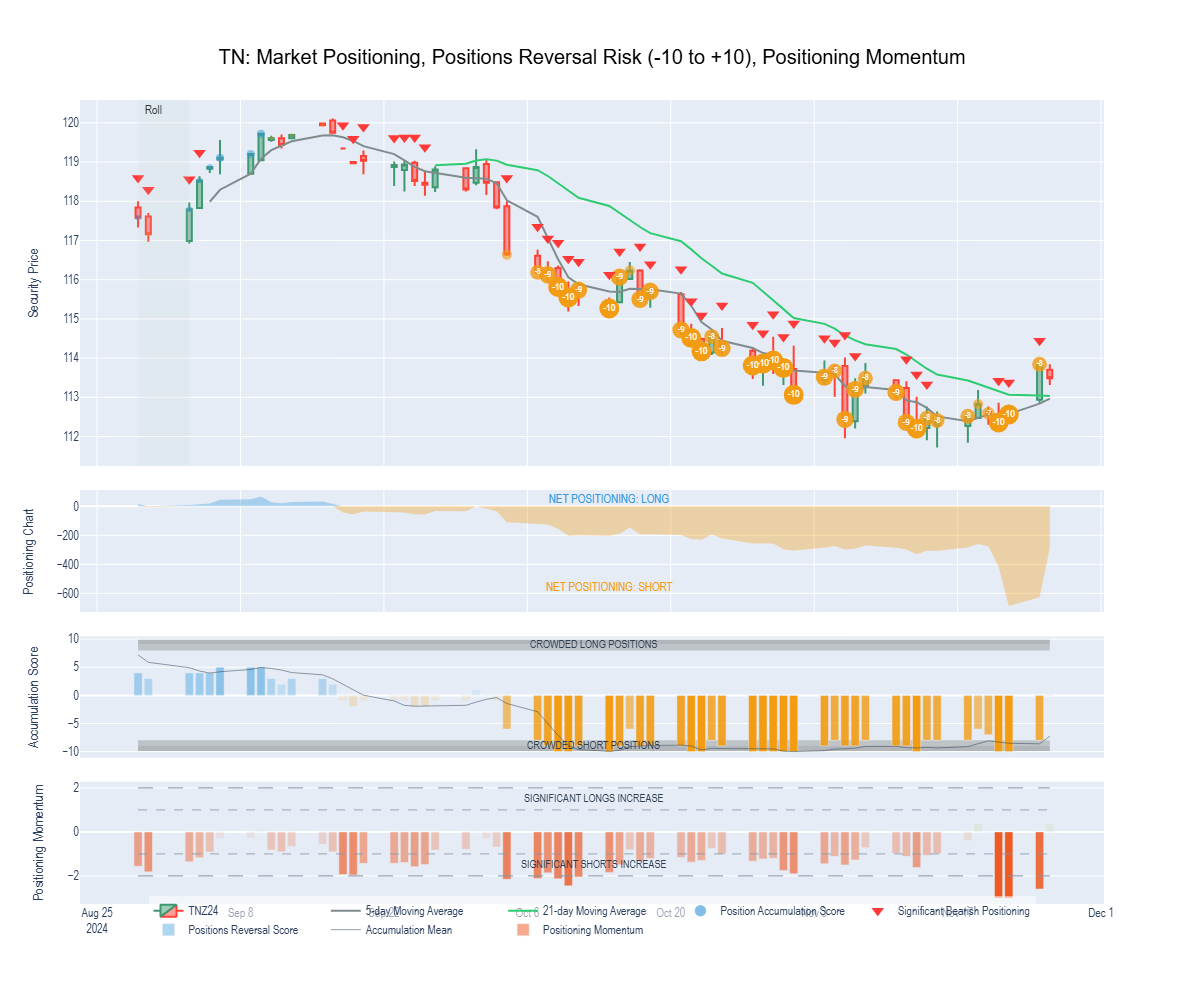

- Daily Positioning Analysis: Evaluates daily changes in market positioning to assess momentum shifts and detect critical trends.

- Reversal Indicators: Identifies potential turning points by highlighting concentrated positions that may lead to long capitulations or short coverings.

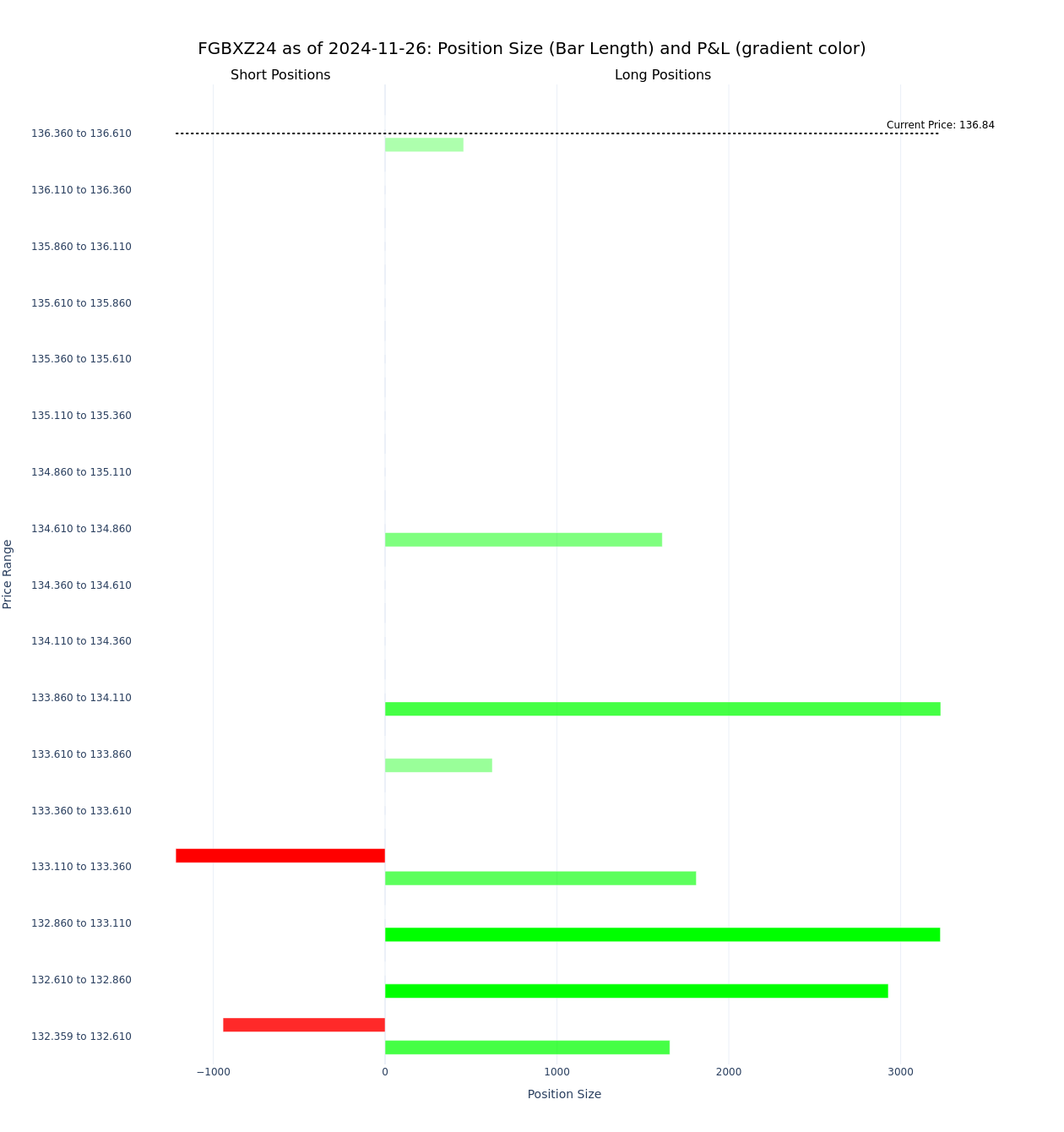

- Profit and Loss Tracking: Monitors the entry prices of identified positions, enabling users to track key price levels and evaluate market participants' profit-and-loss status.

Value to Users

By mapping and continuously tracking market positions, the Futures Positioning Model provides traders and portfolio managers with a real-time edge. It empowers them to:

- Anticipate market moves

- Refine risk management strategies

- Align decision-making with underlying market dynamics

Futures Securities Covered

The Futures Positioning Model supports a diverse range of futures instruments, including:

- US Treasury Futures: Long Bond, Ultra Bond, 10Y, 5Y, 2Y

- US Equity Index Futures: E-mini S&P500, Nasdaq-100, Russell 2000

- EU Bond Futures: Buxl, Bund, Bobl, Schatz, 10Y BTP, 2Y BTP, OAT

- EU Equity Index Futures: Euro Stoxx 50, Stoxx 600 and Banks

- Commodity Futures: Crude Oil, Gold, Copper, Silver

- FX Futures: Major G10 currency pairs

- Crypto Futures: CME Bitcoin (BTC) and Ethereum (ETH)

Comprehensive Analytics and Features

The model delivers daily updates and leverages over 10 years of continuous historical data to provide insights into:

- Long and Short Positions: Current estimations and historical tracking.

- Positioning Momentum: Measurement of the strength and direction of changes in market positioning.

- Position Accumulation: Monitoring of key levels where long and short positions are concentrated.

- Outstanding P&L: Tracking the profit and loss of active positions to gauge market sentiment and vulnerability.

- Relative P&L Pain/Gain: Identification of pressure points where positions may trigger market responses.

Futures Positioning Systematic Strategy

Leveraging the insights provided by the Futures Positioning Model, the Systematic Positioning Strategy transforms data-driven positioning analysis into actionable and performance-focused trading opportunities.

Strategy Features

- Actionable Signals:

- Signals are generated directly from market positioning dynamics, providing clear, data-backed entry and exit points for trading decisions.

- Rigorous Testing:

- Strategies undergo extensive in-sample and out-of-sample backtesting, ensuring their robustness and reliability across varied market conditions.

- Live Trading History:

- The strategy has a proven track record, demonstrating consistent alpha generation through real-world application.

- Uncorrelated Alpha:

- Designed to perform independently of traditional market drivers, these strategies offer a unique, uncorrelated edge for portfolio diversification and risk management.