- JPMorgan survey provides external validation of what the Genesi Positions Model has been signalling.

- The survey’s all-client category for outright short positions — including central banks, real money, and speculative traders — has reached its highest level since mid-February.

- The qualitative insights from the JPMorgan survey align closely with the quantitative signals from the Genesi Model.

A recent JPMorgan Chase & Co. survey of traders, released Wednesday, indicates that bearish sentiment in the U.S. Treasury market is intensifying. The survey’s all-client category for outright short positions — which spans central banks, sovereign wealth funds, real money managers, and speculative traders — has climbed to its highest level since mid-February.

This surge in short positioning aligns closely with signals from the Genesi Positions Model, which has been tracking a steady buildup of bearish exposure in U.S. Treasury futures over recent weeks.

The recent JPMorgan survey provides external validation of what the Genesi Positions Model has been signaling: sentiment in Treasuries is deeply skewed bearish, and positioning is heavily concentrated.

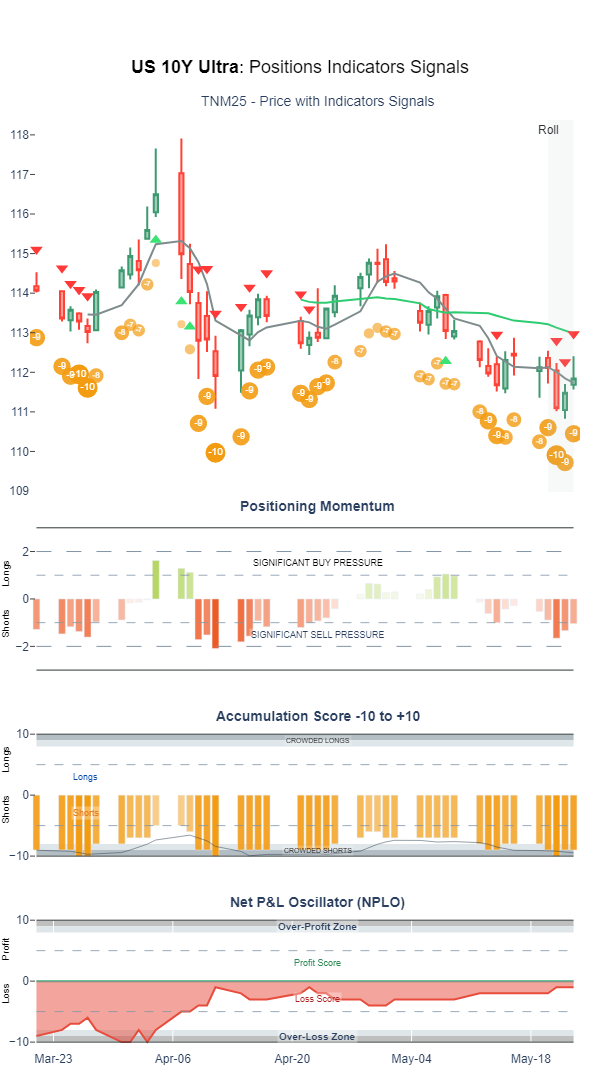

Genesi Model Signals Extreme Positioning

The model’s proprietary Accumulation Score reached -10 this week — one of the most extreme readings in the past 12 months. This score, visualized through orange bars in the subplot, reflects a high concentration of short positions across market participants.

Historically, the model has recorded four prior -10 scores this year, each of which preceded a sharp reversal in positioning — and a corresponding bounce in prices. This repeatability underscores the model’s effectiveness at identifying positioning extremes and potential inflection points.

Mapping Key Reversal Zones

Beyond directional signals, the Genesi Model also maps key price levels where significant clusters of positions have been established. These zones are critical for anticipating potential reversal levels, especially as technical and sentiment factors converge.

This framework enables market participants to gauge where covering pressure may emerge — and how deeply entrenched the current consensus really is.

For the full analysis refer to our recent publication U.S. Treasury Futures Signals Growing Reversal Risk.

Source:

The survey results were originally published by Bloomberg:

"Bond Traders See Treasuries Selloff Going Even Further"