Week-on-Week Positioning Dynamics

As we approach this week’s FOMC meeting, the market remains net long across the curve, a setup similar to that seen ahead of the September meeting, when positioning reached concentrated long levels (“Crowded Longs Ahead of the Fed: Market Vulnerable to Asymmetric Risk (16 Sep 25)”).

Since the rally began on October 10, net longs have increased by 3.5% in the 10Y and 4.5% in the 30Y, with the latter partially offset by a 2.0% rise in shorts. The composition of recent flows suggests the move has been driven primarily by new position initiation rather than short-covering, indicating fresh long exposure and broader market participation ahead of the event.

Positioning Momentum & Imbalances

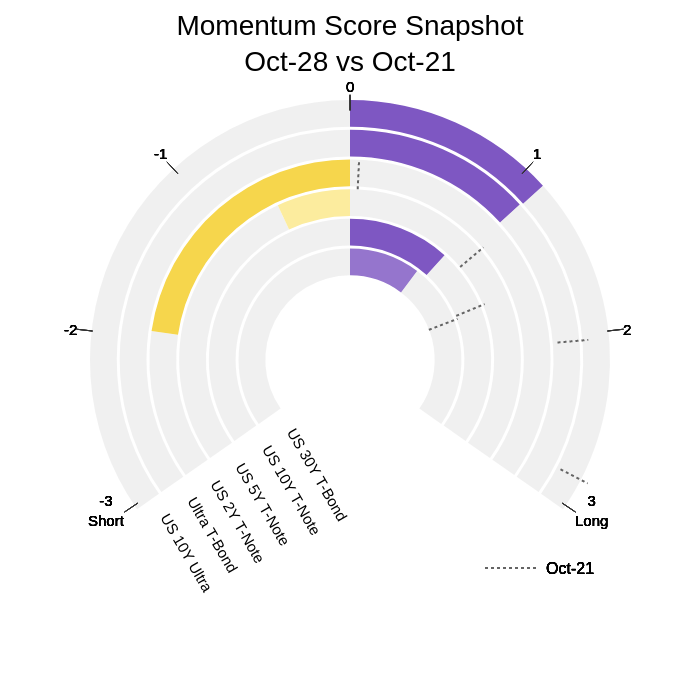

Buying momentum, which had remained firm across both 10Y and 30Y maturities, is now easing from last week’s peak levels. Continued accumulation has pushed 10Y UST futures into concentrated long territory, scoring +9/10 on our Accumulation Score, while the 30Y sits slightly lower at +8, reflecting the emergence of some offsetting short positions.

In comparison, ahead of the September FOMC, positioning was even more extended (+9 and +10 across the curve) and was followed by a post-meeting sell-off as the Fed delivered the expected outcome. While current exposures are somewhat lighter, the setup still reflects an asymmetric risk profile into the October meeting, with markets once again notably long into a policy event.

Momentum Score (Signal: ±1 )

The Momentum Score measures the strength of positioning moves, with values above +2 or below -2 indicating significant positions shifts.

Accumulation Score (-10 to +10)

The Accumulation Score measures the concentration of positions on a scale from -10 to +10, indicating increased risk of position reversals

Key Levels to Watch

The 10Y T-Note and Ultra 10Y continue to show the highest concentration of longs (Accumulation Score: +9), while Positioning Momentum has begun to moderate.

This leaves the market vulnerable to an asymmetric positioning setup, though at less extreme levels than in September.

As was the case ahead of the September Fed meeting, our model signals caution given the current imbalance and asymmetric risk/reward profile, where an “as expected” or disappointing outcome could leave recently accumulated longs exposed to a positioning-driven reversal.

Key positioning clusters and potential reversal levels:

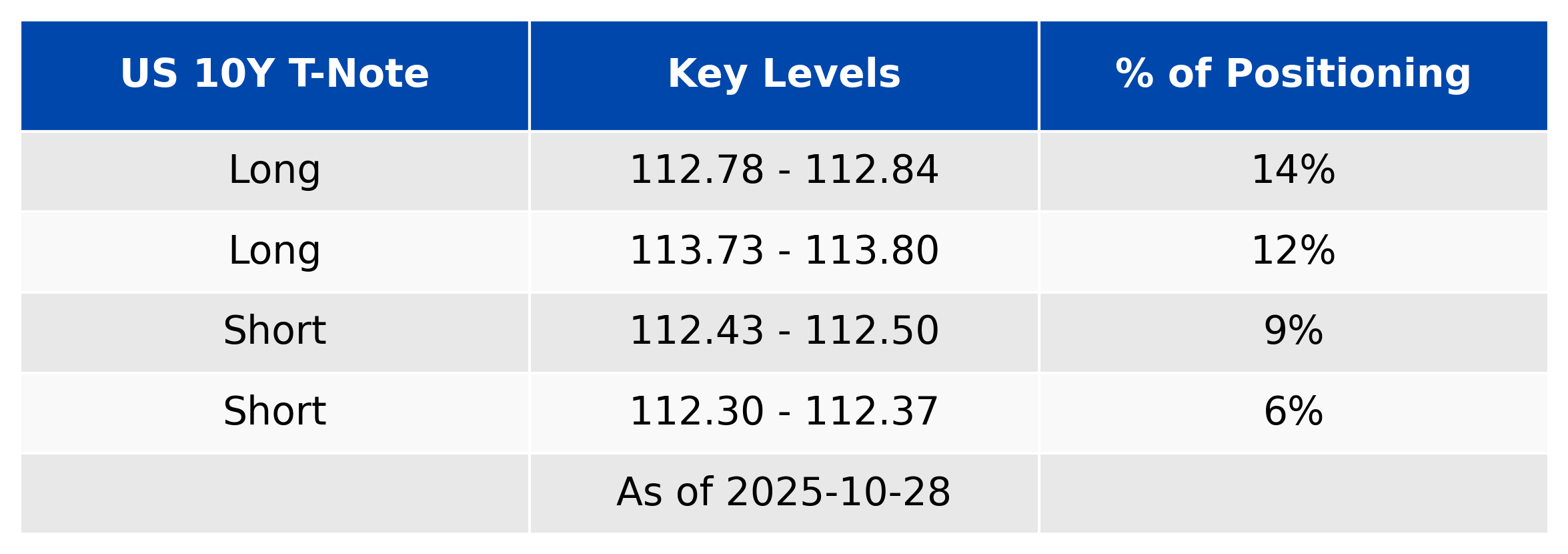

- 10Y T-NOTE:

- 113-23 to 113-25: Second-largest cluster of long positions, currently in negative P&L territory.

- 112-23: Largest concentration of longs; may act as the first downside target in a sell-off scenario.

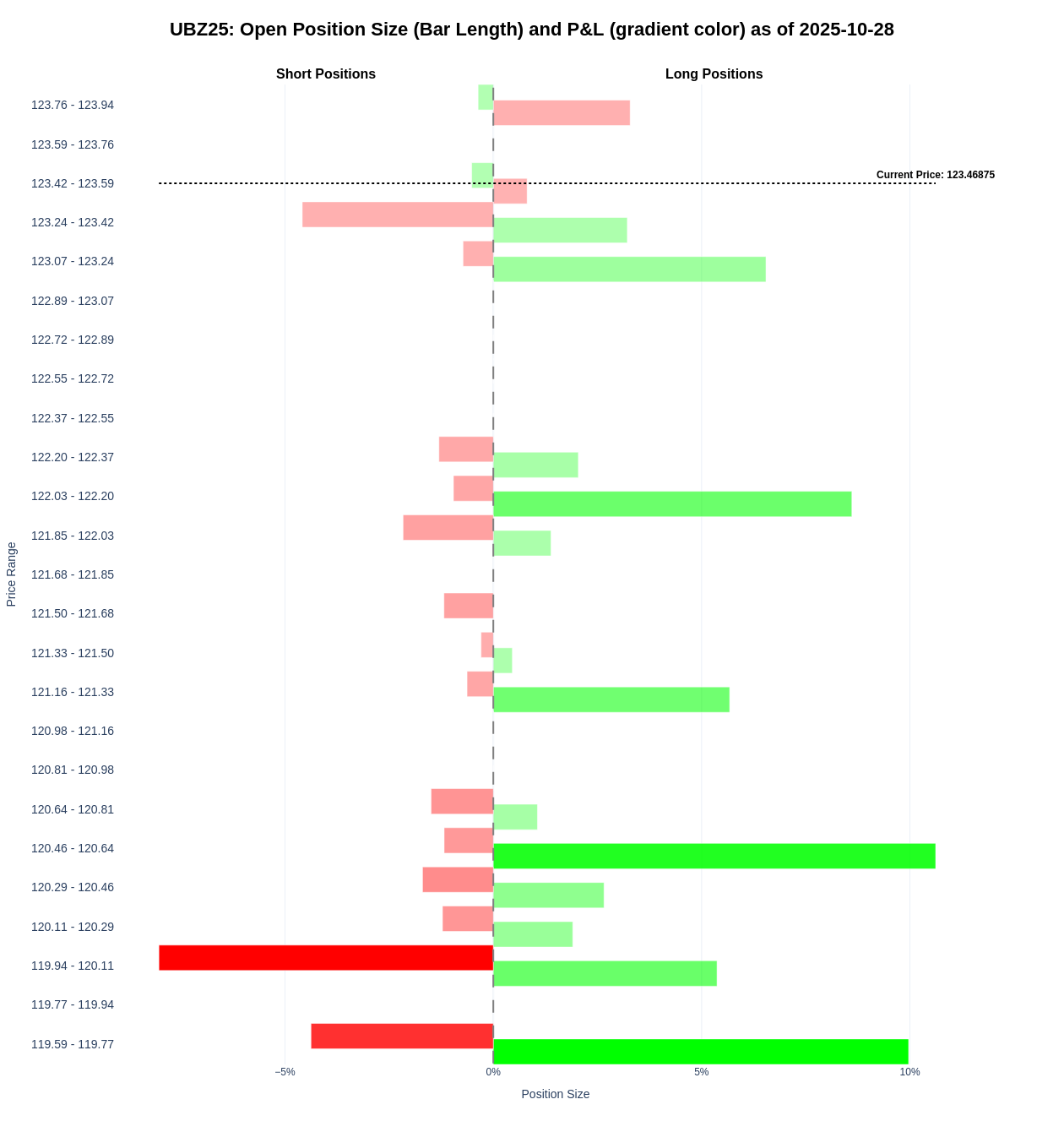

- Ultra 30Y:

- 120-15: First significant cluster of long positions, with additional notable long concentrations just above 122.

This is a preview of the US Treasury Futures - Positioning Update.