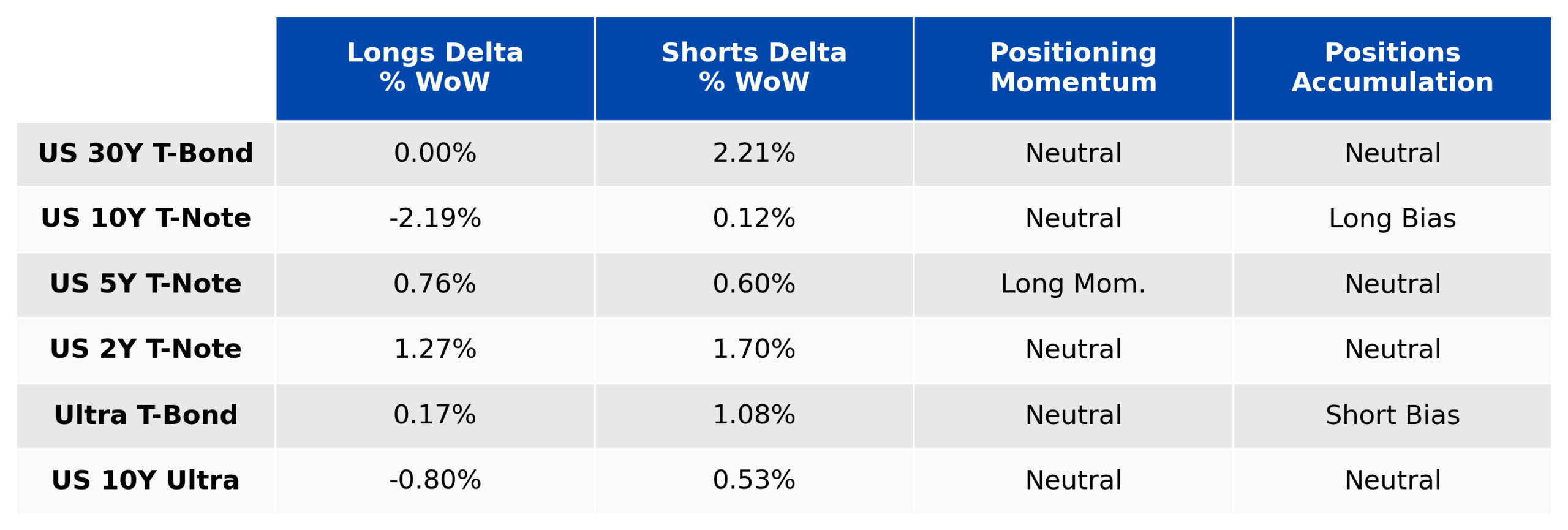

8 Jul 2025

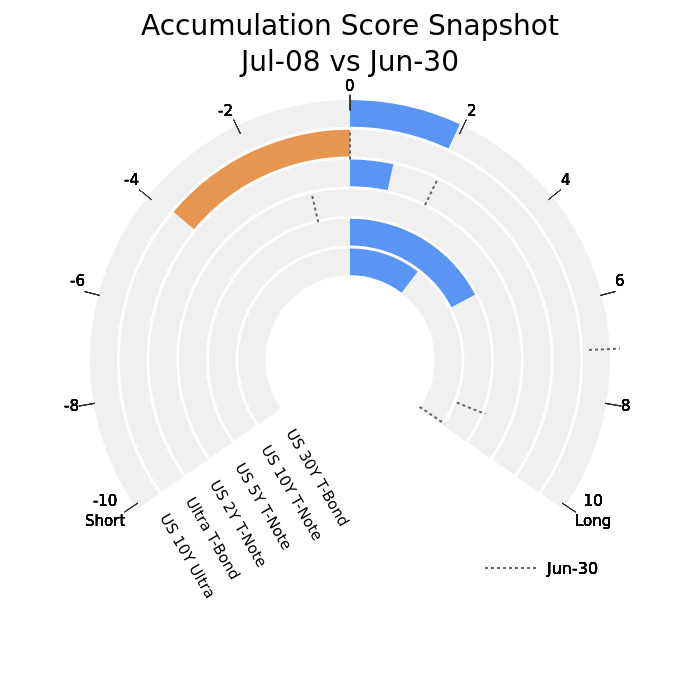

- Accumulation Score peaked last week with maxed-out long signals in 10Y and 30Y — now sharply fading.

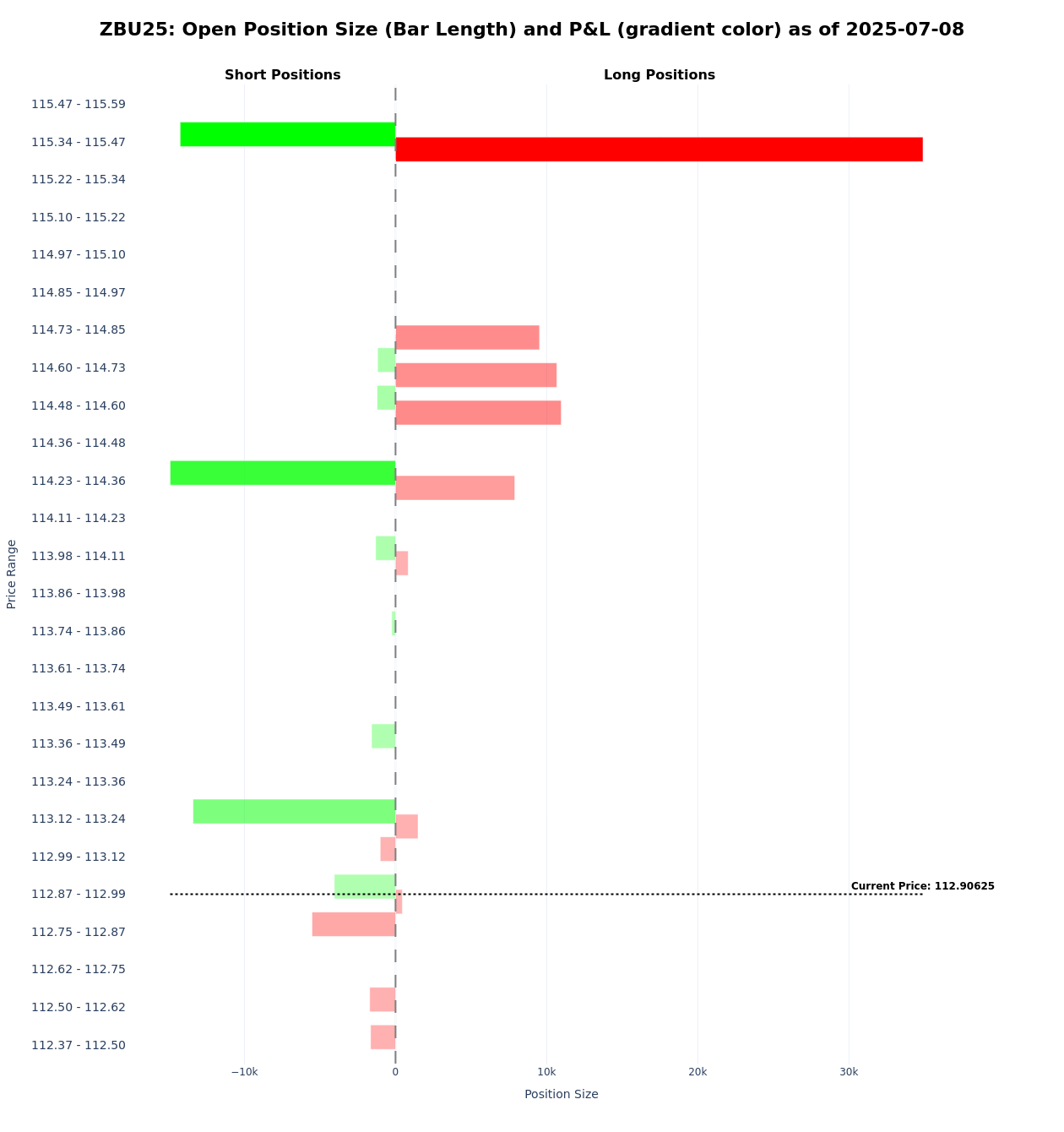

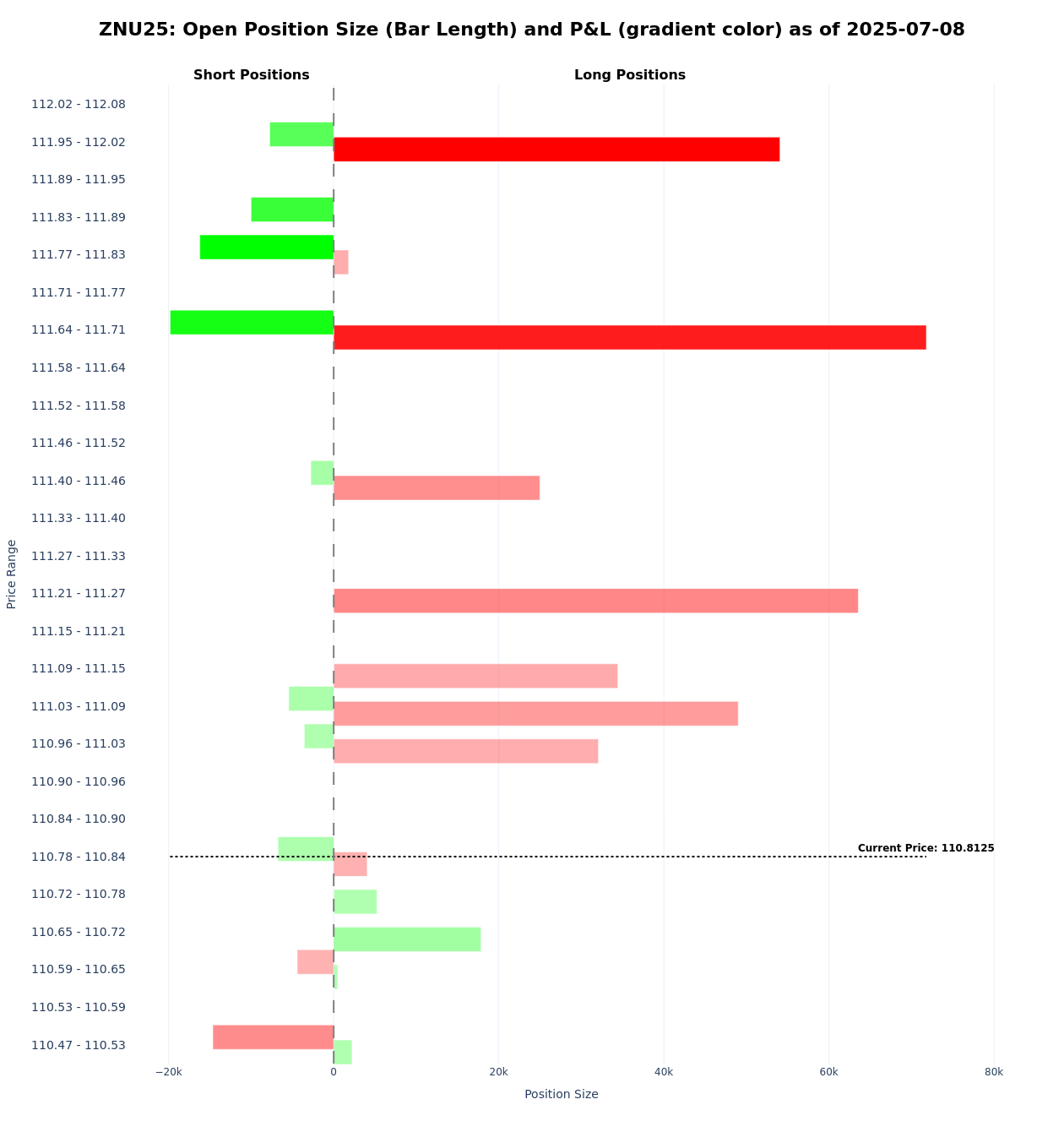

- Long liquidation met by fresh shorts: 10Y positions trimmed, while 30Y and Ultra T-Bond attracted new short interest.

- Momentum neutralizing: Long bias in 10Y cut to +5; 30Y drops to flat after a crowded long signal.

The Accumulation Score delivered a powerful signal last week, flagging concentrated long positions (+10 out of 10) in both the 30Y T-Bond and the 10Y T-Note.

The subsequent four-session sell-off has been driven by long liquidation in the 10Y T-Note (-2.19%) and Ultra 10Y, alongside short buildup at the long end—with 30Y T-Bond shorts increasing by 2.21% and Ultra T-Bond by 1.08%.

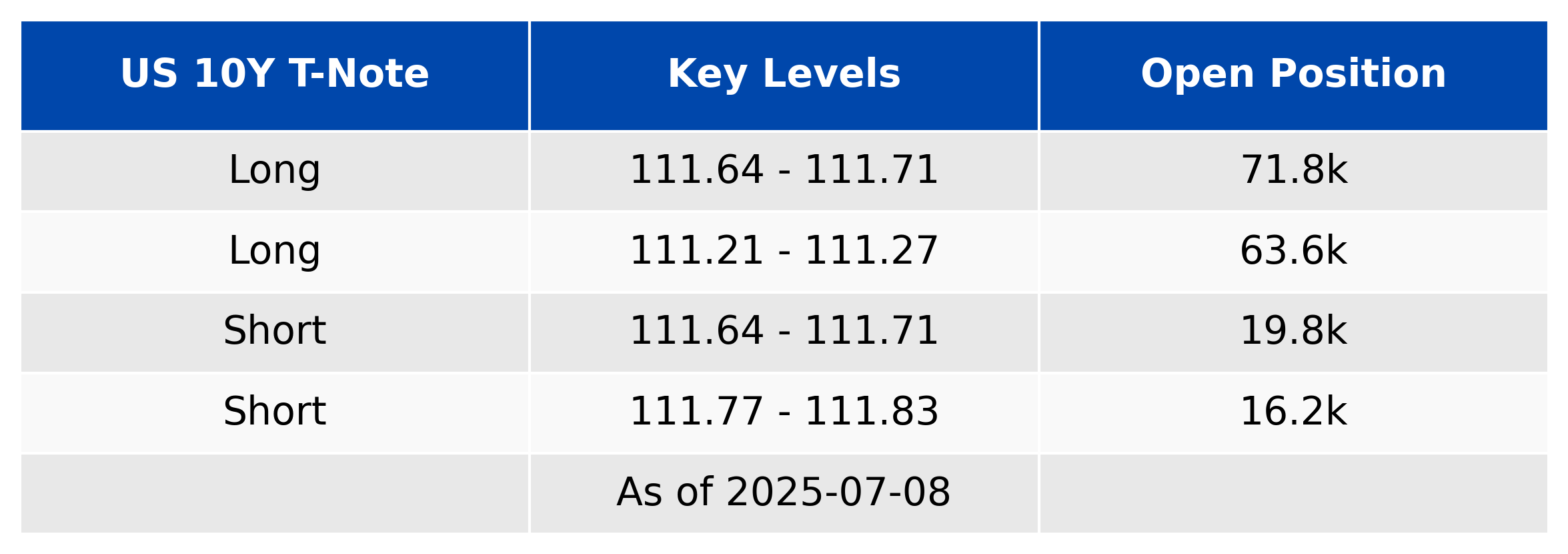

The 10Y T-Note now reflects a +5 long bias, down from the prior extreme. The 30Y T-Bond has shifted to neutral, unwinding its overextended long signal.

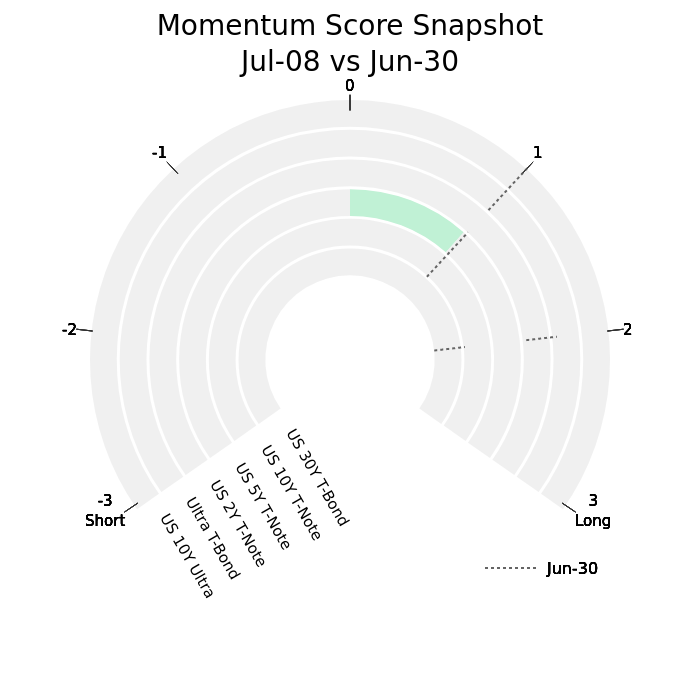

Meanwhile, Long Momentum, which was strong across the curve last week, has now moderated to neutral on all tenors except the 5Y.

Key positioning levels in the 10Y T-Note suggest that most longs are concentrated at 111-22 and 111-08—see full breakdown below.

Positions Overview

Momentum Score (Signal: ±1 )

The Momentum Score measures the strength of positioning moves, with values above +2 or below -2 indicating significant positions shifts.

Accumulation Score (-10 to +10)

The Accumulation Score measures the concentration of positions on a scale from -10 to +10, indicating increased risk of position reversals

Positioning Analysis by Instrument

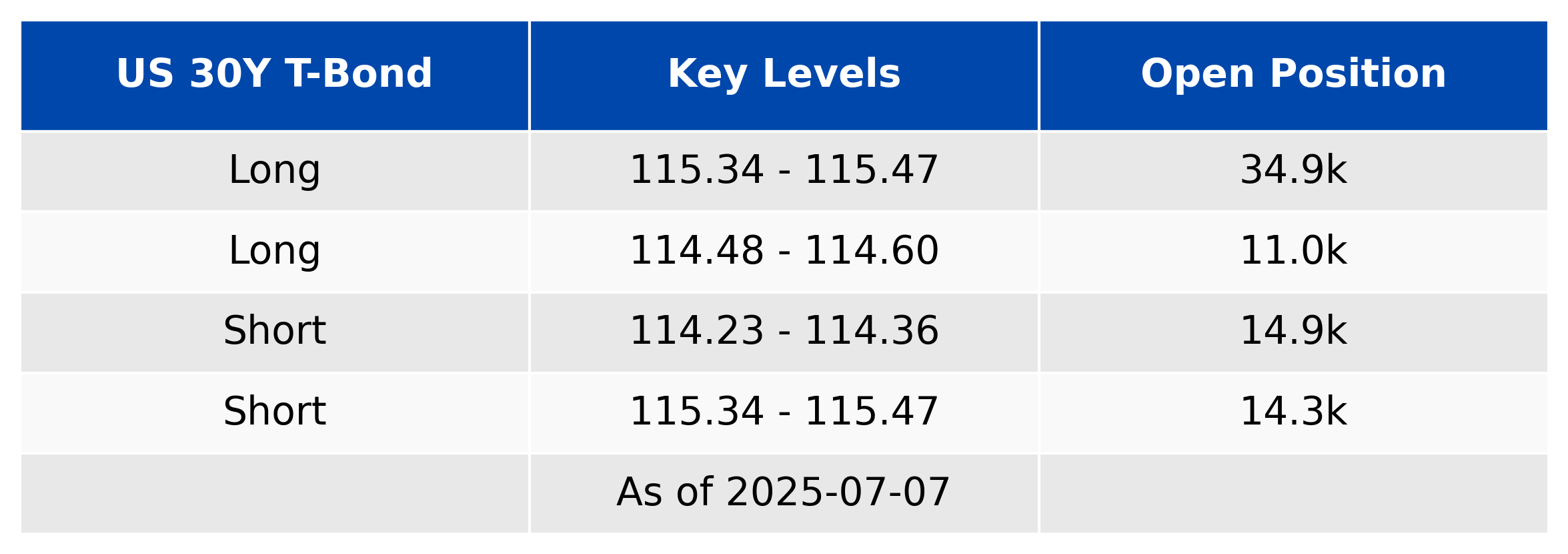

US 30Y T-Bond

Top Open Positions by Level

US 10Y T-Bond

Top Open Positions by Level

Ultra T-Bond