US Congress Trading

Systematic Measurement of US Congress Trading, Lobbying, and Contracting

Introduction to the Model

The US Congress Model offers a comprehensive and systematic measure of key activities that influence the intersection of politics and the financial markets. By leveraging publicly available data, the model evaluates and quantifies the significance of US Congress members trading, corporate lobbying, and government contracts in relation to the performance of stocks within the S&P 500 Index.

Core Features and Methodology

The model processes and classifies publicly available data to ensure relevance and significance for each stock. The analysis culminates in three clear and actionable metrics:

- Congress Trades Score

- This metric measures the significance of trades executed by members of the US Congress. It highlights patterns or noteworthy activities that could signal potential market-moving insights.

- Lobbyist Activity Score

- This score quantifies the lobbying expenditures disclosed by companies within the S&P 500 Index. It provides a measure of corporate influence on regulatory and legislative agendas, offering insights into sectors or companies with strong political engagement.

- Government Contracts Index

- This index identifies and classifies new government contracts awarded to companies, signaling direct government investment or influence on a stock's valuation.

Benefits of the Scoring System

- Straightforward Interpretation:

- The model simplifies complex datasets into actionable scores that are easy to interpret and integrate.

- Versatility:

- These metrics are designed for seamless integration into both discretionary and systematic trading strategies.

Stocks Covered

The model encompasses all stocks listed in the S&P 500 Index, systematically categorized by sector. This comprehensive coverage ensures the model is versatile and easily adaptable to a wide range of portfolio strategies.

Applications

The US Congress Model empowers investors to:

- Identify market opportunities linked to congressional and lobbying activities.

- Monitor and quantify the impact of government contracts on specific stocks or sectors.

- Leverage political and corporate activity data to enhance portfolio management strategies.

- This model bridges the gap between political influence and market performance, offering a unique perspective for informed investment decisions.

The Congress Trades Score (Blue Bars) Flags Notable Entries in NOW Stock as Price Rises from 825 to 1,048

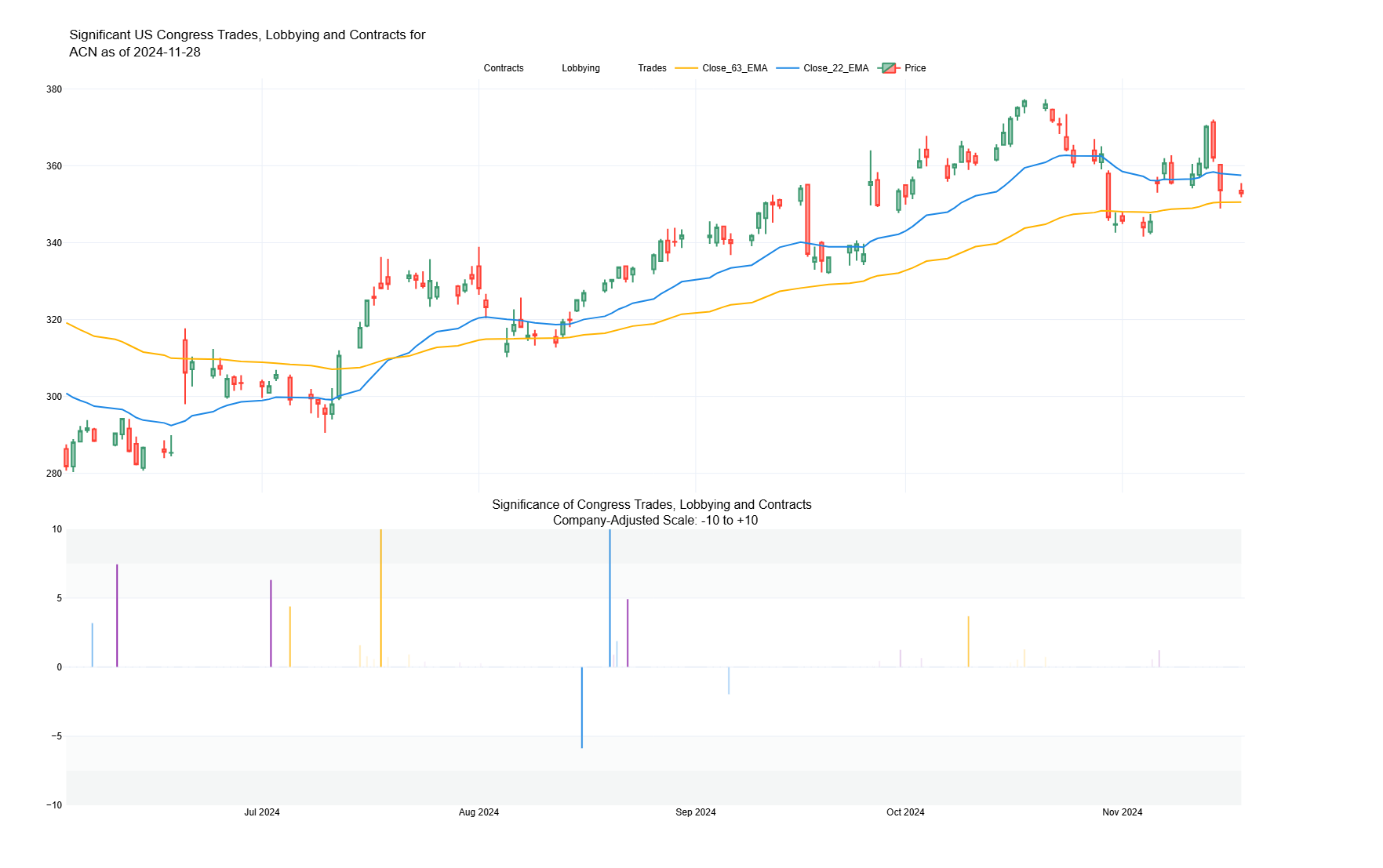

ACN: Lobbyist Activity Score (Yellow Bars) & Government Contracts Index (Purple Bars) Increase as Stock Soars

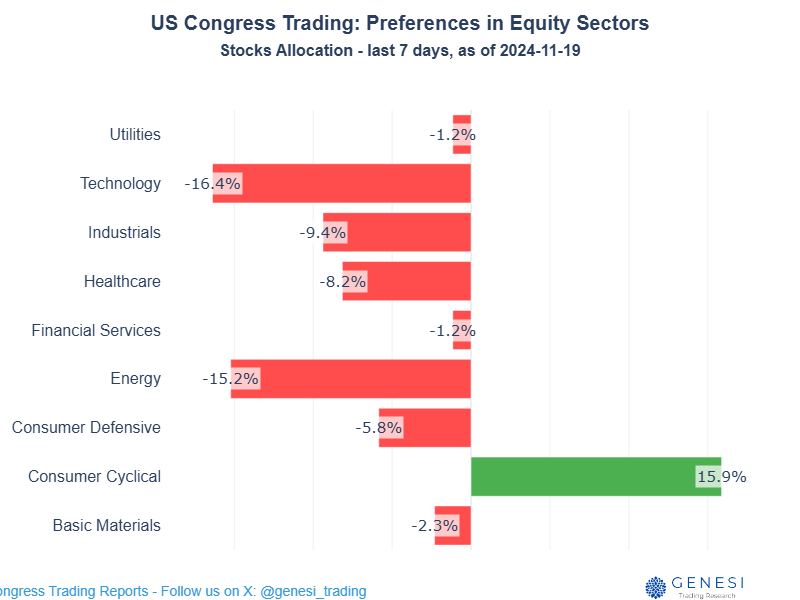

US Congress Members' Stock Allocation by Sector

IBM Supported By The Congress Trades Score (Blue Bars), Lobbyist Activity Score (Yellow Bars) & Government Contracts Index (Purple Bars)